Apple Stock App for Android: A Comprehensive Guide to Tracking Your Investments

Are you an Android user who wants to stay up-to-date with the latest Apple stock trends? Look no further! In this comprehensive guide, we will explore the top Apple stock apps available for Android devices. Whether you are a seasoned investor or just starting out, these apps will provide you with all the tools you need to track, analyze, and make informed decisions about your investments. So, let's dive in and discover the best Apple stock app for Android!

With the ever-increasing popularity of smartphones, it's no wonder that more and more investors are turning to mobile apps for managing their portfolios. Gone are the days of relying solely on desktop applications or websites to keep track of your investments. The convenience and ease of use offered by stock market apps have revolutionized the way we monitor our stocks, and the Apple stock app for Android is no exception.

Introduction to Apple Stock App for Android

In this section, we will provide an overview of the Apple stock app for Android, its features, and how it can benefit investors. We will explore its user interface, real-time data updates, and customization options. By the end of this section, you will have a clear understanding of what the app has to offer.

When it comes to tracking Apple stocks on your Android device, having a reliable and feature-rich app is essential. The Apple stock app for Android is designed to provide users with a seamless experience in monitoring and managing their investments. With its intuitive user interface and powerful features, this app offers a comprehensive solution for investors of all levels.

User Interface and Navigation

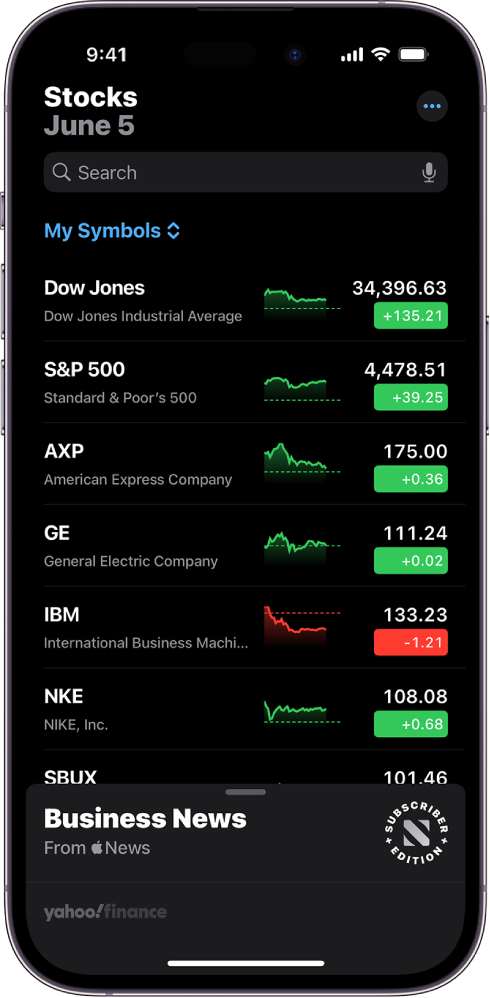

One of the key aspects of any stock market app is its user interface. The Apple stock app for Android boasts a clean and intuitive design, making it easy for users to navigate through the various sections and features. The app's home screen provides a quick overview of your portfolio, displaying key information such as the current value of your investments, percentage change, and portfolio performance.

With just a few taps, you can access detailed information about individual stocks, including historical price charts, news articles, and analyst recommendations. The app also allows you to customize the layout and display preferences, ensuring that you can personalize your investment tracking experience.

Real-Time Data Updates

Keeping track of real-time stock prices is crucial for making informed investment decisions. The Apple stock app for Android ensures that you have access to the latest market data at your fingertips. With real-time stock quotes, you can monitor the price movements of Apple stocks throughout the trading day.

Besides real-time prices, the app also provides other essential data points, such as volume traded, market capitalization, and dividend yield. This comprehensive range of information allows you to analyze the performance of Apple stocks in detail and make well-informed decisions based on accurate and up-to-date data.

Customization Options

No two investors are the same, and the Apple stock app for Android recognizes this by offering a range of customization options. Whether you prefer a dark or light theme, want to display your portfolio in a particular currency, or have specific alert preferences, this app allows you to tailor it to your individual needs.

By customizing the app's settings, you can create a personalized investment tracking experience that aligns with your investment goals and preferences. Whether you are a day trader who needs frequent price alerts or a long-term investor who wants to monitor overall portfolio performance, the Apple stock app for Android has got you covered.

Top Apple Stock Apps for Android

Here, we will review the top-rated Apple stock apps available for Android devices. We will discuss their unique features, user reviews, and overall performance. By comparing different apps, readers can make an informed decision about which one suits their investment needs the best.

1. Stock Market App A: A Feature-Packed Option

With a sleek interface and a wide range of features, Stock Market App A is a popular choice among Android users. This app provides real-time stock quotes, customizable watchlists, and comprehensive technical analysis tools. Users can track market indices, view company profiles, and receive personalized news alerts. The app also offers in-depth charting capabilities, allowing investors to analyze stock trends and identify potential buying or selling opportunities.

Key Features of Stock Market App A

- Real-time stock quotes and market data

- Customizable watchlists and portfolio tracking

- Technical analysis tools, including charting and indicators

- Personalized news alerts and market analysis

- Company profiles and financial statements

User Reviews:

"Stock Market App A is my go-to app for tracking my Apple stock investments. The real-time quotes and customizable watchlists make it easy to stay on top of the market. The technical analysis tools are also a great help in identifying trends and making informed decisions."

2. Stock Market App B: A User-Friendly Option

If you prefer a user-friendly interface and a simple yet powerful set of features, Stock Market App B might be the right choice for you. This app provides real-time stock quotes, personalized news feeds, and portfolio tracking capabilities. Users can easily add stocks to their watchlist, track their performance, and receive timely alerts. The app also offers basic charting tools, allowing investors to visualize stock price movements over time.

Key Features of Stock Market App B

- Real-time stock quotes and market data

- Personalized news feeds and alerts

- Portfolio tracking and performance analysis

- User-friendly interface and easy-to-use navigation

- Basic charting tools for visualizing stock price movements

User Reviews:

"Stock Market App B is perfect for investors who want a straightforward app that gets the job done. The real-time quotes and personalized news feeds keep me informed, and the portfolio tracking feature helps me monitor my investments. It's a great option for those who want a user-friendly experience without overwhelming features."

Key Features to Look for in an Apple Stock App

In this section, we will delve into the essential features that investors should consider when selecting an Apple stock app for their Android device. We will discuss the importance of real-time data, portfolio tracking, news alerts, and other functionalities that can enhance the user experience.

1. Real-Time Data Updates

One of the crucial features to look for in an Apple stock app is real-time data updates. The ability to access up-to-date stock prices, volume traded, and other market data is essential for making informed investment decisions. Real-time data ensures that you have the most accurate information at your disposal, allowing you to react quickly to market movements and execute trades at the right time.

The Importance of Real-Time Data

Real-time data is particularly important for investors who engage in short-term trading or day trading strategies. By having access to real-time stock quotes, you can monitor price movements closely and identify potential buying or selling opportunities. Real-time data also allows you to track the performance of your portfolio accurately and make timely adjustments to your investment strategy.

2. Portfolio Tracking

Another essential feature to consider in an Apple stock app is portfolio tracking. The ability to monitor the performance of your investments and track your portfolio's overall value is crucial for successful stock market investing. A good portfolio tracking feature should provide a comprehensive overview of your holdings, including the current value, percentage change, and performance over time.

Benefits of Portfolio Tracking

Portfolio tracking allows you to evaluate the performance of your investments and assess whether your investment strategy is yielding the desired results. By tracking your portfolio, you can identify underperforming stocks, rebalance your holdings, and make informed decisions about buying or selling. The ability to view your portfolio's performance at a glance enables you to stay on top of your investments and make adjustments as needed.

3. News Alerts and Market Analysis

Staying informed about the latest news and market trends is essential for successful investing. An Apple stock app that provides news alerts and market analysis can help you make well-informed decisions. Look for an app that offers personalized news feeds, allowing you to receive relevant articles and updates about Apple and the stock market in general.

The Benefits of News Alerts and Market Analysis

News alerts and market analysis provide valuable insights into the factors that can impact stock prices. By staying informed about Apple's latest developments, product launches, financial reports, and industry trends, you can make better predictions about stock performance. Additionally, market analysis can help you understand the broader market conditions and identify potential investment opportunities.

Setting Up Your Apple Stock App

Once you have chosen the ideal Apple stock app, it's time to set it up to suit your preferences. In this section, we will guide you through the process of customizing the app, adding your portfolio, and setting up personalized alerts. By the end, you will have a fully personalized stock app that meets your specific needs.

1. Customizing the App

When setting up your Apple stock app, take advantage of the customization options available to tailor it to your preferences. Begin by selecting your preferred theme, whether it's a dark or light mode. This ensures that the app's appearance aligns with your visual preferences and enhances your user experience.

ChoosingChoosing Display Preferences

In addition to the theme, you can also customize the display preferences of the app. This includes selecting the currency in which you want to view your portfolio and stock prices. By setting it to your local currency or the currency of your choice, you can easily understand the value of your investments without the need for constant conversions.

Furthermore, you may have preferences regarding the layout of the app. Some users prefer a compact view with all the essential information on a single screen, while others prefer a more detailed view with additional charts and data. Explore the layout options offered by the app and choose the one that suits your needs and preferences best.

Adding Your Portfolio

Once you have customized the app's appearance, it's time to add your portfolio. Most Apple stock apps for Android allow you to manually add the stocks you own or import your portfolio from a brokerage account. Adding your holdings enables the app to track and display your portfolio's performance accurately.

When adding stocks to your portfolio, make sure to enter the correct ticker symbol or company name to ensure accurate tracking. You may also have the option to categorize your stocks into different portfolios or watchlists, making it easier to track specific investments or sectors of interest.

Setting Up Personalized Alerts

One of the valuable features of Apple stock apps for Android is the ability to set up personalized alerts. These alerts can notify you of significant price movements, news articles, or other events related to your stocks. By setting up alerts, you can stay informed without constantly monitoring the app.

Consider the types of alerts that would be most useful to you. For example, you may want to receive an alert when the price of an Apple stock reaches a certain threshold or when there is breaking news about the company. Customize the alerts according to your preferences and investing strategy to ensure you stay informed and can act promptly when necessary.

Analyzing Apple Stock Trends

Understanding how to analyze Apple stock trends is crucial for making informed investment decisions. In this section, we will explore various techniques and indicators that can help investors evaluate the performance of Apple's stock. From technical analysis to fundamental analysis, readers will gain valuable insights into assessing stock trends effectively.

1. Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends in stock prices. Traders who practice technical analysis use various tools and indicators to make predictions about future price movements. Some commonly used technical analysis tools include moving averages, relative strength index (RSI), and Bollinger Bands.

Using Moving Averages

Moving averages are one of the fundamental tools in technical analysis. They help smooth out price fluctuations and identify trends by calculating the average price over a specific period. For example, a 50-day moving average represents the average price of a stock over the past 50 trading days.

Traders often use moving averages to identify support and resistance levels. When the price of a stock crosses above its moving average, it may indicate a bullish trend, while a cross below the moving average may suggest a bearish trend. By analyzing the relationship between different moving averages, traders can gain insights into the strength and direction of a stock's trend.

Understanding the Relative Strength Index (RSI)

The Relative Strength Index (RSI) is another popular technical indicator used to assess the strength and momentum of a stock's price movements. RSI measures the magnitude of recent price changes and compares the number of up days to down days over a specific period.

RSI values range from 0 to 100, with readings above 70 indicating an overbought condition and readings below 30 suggesting an oversold condition. Traders often use RSI to identify potential trend reversals. For example, if the RSI reaches an extreme level, such as above 70, it may signal that the stock is overbought and due for a pullback.

Utilizing Bollinger Bands

Bollinger Bands are bands plotted above and below the moving average of a stock's price. These bands represent the volatility of the stock. The width of the bands expands and contracts based on the stock's price volatility. When the price is near the upper band, it may indicate that the stock is overbought, while a price near the lower band may suggest an oversold condition.

Traders often use Bollinger Bands to identify periods of low volatility, known as Bollinger Squeeze, which may be followed by significant price moves. By analyzing the width of the bands, traders can gain insights into the potential volatility and direction of future price movements.

2. Fundamental Analysis

Fundamental analysis involves evaluating a company's financial health and performance to determine its intrinsic value. Investors who practice fundamental analysis assess various factors such as revenue, earnings, cash flow, and industry trends to make investment decisions.

Examining Financial Statements

When conducting fundamental analysis on Apple stock, investors examine the company's financial statements, including the income statement, balance sheet, and cash flow statement. These statements provide insights into Apple's revenue growth, profitability, debt levels, and cash flow generation.

By analyzing these financial statements, investors can assess Apple's overall financial health and stability. They can determine if the company is generating consistent profits, managing its debt effectively, and experiencing positive cash flow. Fundamental analysis also involves comparing Apple's financial ratios to industry benchmarks and evaluating its competitive position in the market.

Evaluating Industry and Market Trends

Understanding the broader industry and market trends is an essential aspect of fundamental analysis. Investors assess factors such as market demand, technological advancements, and competitive landscape to evaluate the growth potential of Apple and its ability to stay ahead of the competition.

By analyzing industry trends, investors can identify potential risks and opportunities that may impact Apple's stock performance. For example, if there is a shift in consumer preferences towards a competitor's product or a decline in overall market demand for Apple's products, it may affect the company's future revenue and profitability.

Maximizing Your Investment Returns

Now that you have a solid understanding of the Apple stock app and how to analyze trends, it's time to explore strategies for maximizing your investment returns. In this section, we will discuss techniques such as dollar-cost averaging, diversification, and rebalancing that can help achieve long-term success in the stock market.

1. Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money regularly, regardless of the stock's price. By consistently investing over time, you can take advantage of market fluctuations. When prices are low, you buy more shares, and when prices are high, you buy fewer shares.

The Benefits of Dollar-Cost Averaging

Dollar-cost averaging helps smooth out the impact of market volatility on your investments. It eliminates the need to time the market and reduces the risk of making poor investment decisions based on short-term price movements. Over time, this strategy can result in a lower average cost per share and potentially higher returns.

2. Diversification

Diversification is a risk management strategy that involves spreading your investments across different asset classes, sectors, and geographic regions. By diversifying your portfolio, you can reduce the impact of a single stock's performance on your overall investment returns.

The Benefits of Diversification

Diversification helps mitigate the risk of significant losses by ensuring that a decline in one investment is offset by gains in others. By investing in a mix of stocks, bonds, and other asset classes, you can potentially capture different sources of returns and protect your portfolio from the volatility of individual stocks.

3. Regular Portfolio Rebalancing

Regular portfolio rebalancing involves periodically adjusting the allocation of your investments to maintain your desired asset allocation. As the value of different investments fluctuates over time, your portfolio's weightings may deviate from your original targets.

The Benefits of Portfolio Rebalancing

Portfolio rebalancing ensures that you are not overly exposed to any single investment or asset class. By selling assets that have performed well and buying assets that have underperformed, you can maintain a consistent risk profile and potentially capture opportunities for future growth.

Risks and Challenges of Investing in Apple Stock

Investing in any stock comes with its fair share of risks and challenges, and Apple is no exception. In this section, we will discuss the potential pitfalls and factors that can impact Apple's stock performance. By understanding the risks involved, readers can make more informed decisions and mitigate potential losses.

1. Market Volatility

One of the primary risks of investing in Apple stock, like any other stock, is market volatility. Stock prices can fluctuate significantly based on various factors such as economic conditions, market sentiment, and company-specific news. These fluctuations can result in significant gains or losses, depending on the timing of buying and selling.

The Impact of Market Volatility

Market volatility can cause short-term price swings that may be unrelated to a company's underlying fundamentals. Investors need to be prepared for these fluctuations and have a long-term investment horizon to ride out market turbulence. It's essential to focus on the company's long-term prospects and not be swayed by short-term price movements.

2

Competition and Technological Advancements

Apple operates in a highly competitive industry, and technological advancements can impact the company's market position. Competitors may introduce innovative products that could disrupt Apple's market share or offer similar features at a lower cost. Additionally, rapid changes in technology can render certain products or services obsolete, affecting Apple's profitability.

It's important for investors to closely monitor Apple's competitive landscape and its ability to innovate and adapt to changing market trends. Assessing the company's research and development efforts, product pipeline, and partnerships can provide insights into its future growth potential and competitive advantage.

Regulatory and Legal Risks

Regulatory and legal risks are factors that can impact Apple's stock performance. Changes in government regulations, such as antitrust laws or data privacy regulations, may affect Apple's business operations and profitability. Legal disputes, patent infringements, or intellectual property challenges can also pose risks to the company's financial stability and reputation.

Investors should stay informed about any regulatory or legal developments that may impact Apple and assess the potential implications for the company's future growth and profitability.

Staying Informed: Apple Stock News and Updates

Keeping up with the latest news and updates about Apple is crucial for any investor. In this section, we will explore various resources and platforms that can provide reliable and timely information about Apple's stock. From financial news websites to social media platforms, readers will discover ways to stay informed and make well-timed investment decisions.

1. Financial News Websites and Publications

Financial news websites and publications are valuable sources of information for investors. Websites such as Bloomberg, CNBC, and Reuters provide comprehensive coverage of Apple's stock, including news articles, analysis, and expert opinions. These platforms offer insights into the factors that may impact Apple's stock performance, such as product launches, financial results, and industry trends.

Benefits of Financial News Websites

Financial news websites provide real-time updates and in-depth analysis, enabling investors to stay informed about the latest developments. By following reputable sources, investors can gain a deeper understanding of Apple's business and make well-informed investment decisions based on reliable information.

2. Company Investor Relations

Apple's investor relations website is an excellent resource for accessing official company announcements, financial reports, and presentations. The investor relations section provides a wealth of information about Apple's financial performance, strategic initiatives, and upcoming events, such as earnings releases and shareholder meetings.

Benefits of Company Investor Relations

By regularly visiting Apple's investor relations website, investors can stay informed about the company's official communications. This allows them to access accurate and up-to-date information directly from the source, ensuring they have the most reliable information for making investment decisions.

3. Social Media and Online Communities

Social media platforms and online communities can also be valuable sources of information for Apple stock investors. Platforms like Twitter, Reddit, and StockTwits often have dedicated communities of investors and market enthusiasts who share news, analysis, and insights about Apple and other stocks.

Benefits of Social Media and Online Communities

Engaging with social media and online communities can provide investors with alternative perspectives and real-time discussions about Apple stock. However, it's important to critically evaluate the information shared on these platforms and verify it with reliable sources before making investment decisions.

Troubleshooting and FAQs

Even with the best Apple stock app, users may encounter technical issues or have questions about specific features. In this section, we will address common troubleshooting scenarios and frequently asked questions, providing readers with the necessary solutions and clarifications.

1. Troubleshooting Technical Issues

Issue: App Crashes Frequently

Possible Solution: Try closing the app and restarting your device. If the issue persists, check for app updates or reinstall the app. If the problem continues, contact the app's customer support for further assistance.

Issue: Delayed or Inaccurate Data

Possible Solution: Ensure that you have a stable internet connection. Refresh the app or manually update the data. If the problem persists, contact the app's customer support or check for any known data issues or server maintenance notifications.

2. Frequently Asked Questions

Q: Can I access the Apple stock app on multiple devices?

A: Most Apple stock apps for Android support multiple device access. You can log in to your account from different devices using your credentials, allowing you to track your investments seamlessly across platforms.

Q: Can I trade Apple stocks directly through the app?

A: It depends on the app and the brokerage integration it offers. Some apps provide direct trading capabilities, allowing you to execute trades within the app. However, others may require you to link your brokerage account or redirect you to the brokerage platform for trading.

Your Path to Successful Apple Stock Investing

In this final section, we will summarize the key takeaways and highlight the importance of utilizing the Apple stock app for Android. We will emphasize the potential benefits of staying informed, analyzing trends, and making well-informed investment decisions. By following the strategies outlined in this guide, readers can embark on their path to successful Apple stock investing.

Investing in Apple stock can be a rewarding journey, but it requires staying informed and making informed decisions. By utilizing the Apple stock app for Android, investors can access real-time data, track their portfolios, and receive personalized alerts. This app provides a comprehensive solution for monitoring and managing investments, allowing investors to make well-informed decisions based on accurate and up-to-date information.

By analyzing Apple stock trends using both technical and fundamental analysis, investors can gain valuable insights into the stock's performance and make predictions about future price movements. Additionally, employing strategies such as dollar-cost averaging, diversification, and regular portfolio rebalancing can help maximize investment returns and manage risk.

It's important to be aware of the risks and challenges associated with investing in Apple stock, such as market volatility, competition, and regulatory risks. By understanding these factors, investors can make more informed decisions and take appropriate measures to mitigate potential losses.

Staying informed about Apple's news and updates is crucial for successful investing. By utilizing financial news websites, following Apple's investor relations, and engaging with online communities, investors can access reliable information and gain insights into the company's performance and future prospects.

Finally, it's important to remember that successful investing requires a disciplined and long-term approach. By following the strategies outlined in this guide and leveraging the features of the Apple stock app for Android, readers can embark on their path to successful Apple stock investing with confidence and knowledge.